how to pay cash app fee

Select the payment that you want to review. 125 fee minimum 025 on instant deposits.

How To Use Cash App Send And Receive Money For Free Includes Free 5 Youtube

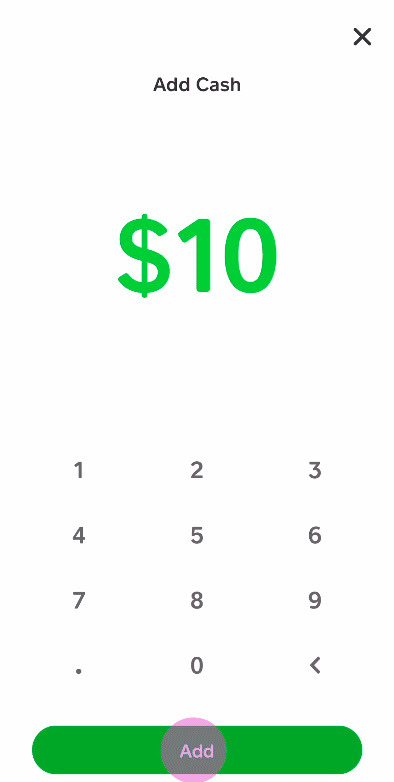

We currently do not offer adding cash from a store or ATM.

. Cash App charges a fee for instant transfers 05 to 175 of the transfer amount with a minimum fee of 025 but you can also choose a. It is a regulatory fee of two categories SEC Fee and TAC Fee. 2 USD Cash App fee to make ATM withdrawals waived if you receive your salary to your Cash App account.

Add Cash from Bank. Cash App is free to send receive and transfer money using a debit card or bank account. If you want to send a payment on Cash App all you need to do is.

To send a payment. A 3 percent fee on a 50 purchase translates to a 15 transaction fee. You will be assessed a 50 fee with the credit card or 3 percent of the purchase.

When you use your debit card or bank account to make a payment Cash App does not charge you any fees. Enter an email address phone number or Cashtag. You agree to pay the applicable fees disclosed to you when you create your Cash for Business Account.

Cash App PayPal⁵. Cash app fees can often be avoided by choosing the slower option and by never paying by credit card. Here are the fees for Cash App business accounts.

Tap the Payments tab on your Cash App to get to the home screen. Tap the QR Scanner on the top left corner of the screen. 15 50 5150.

You will ultimately pay. Provide the recipients email address phone number or Cashtag enter what the payment is for and click Pay again. Cash App Support Receiving a Payment.

29 fixed fee to send a domestic USD payment funded by card. Once youve verified your account by giving information like your name date of birth etc those limits are lifted according to a Cash App representative. All fees are charged at the time we process a transaction and are deducted first from the transferred or collected funds.

Free to open an account. Regulatory fees may apply when investing. Transfers are shipped immediately and can be deposited into a national bank account the same day for a fee or within one to three days free of charge.

How to pay Square Sellers or select third party merchants using the Cash App QR scanner. Many standard transactions with Cash App are free. Can You Send 5000 Through Cash App.

Tap the Activity tab on your Cash App home screen. Credit card transfers will have a 3 transaction fee. Some fees like ATM charges will be reimbursed up to 3 times per month and up to 7 per withdrawal if you receive at least 300 in direct deposits to your Cash App account.

Open the Cash App. Enter the amount you want to send. Enter the purpose of the payment - for example last nights dinner.

Every time you use your credit card to send money Cash App will charge you a 3 fee. Users are allowed to send up to 250 within any seven-day period and receive up to 1000 within any 30-day period according to the website. What is the cost of a 50 immediate deposit with Cash App.

However a government fee might imply all the trading you wish to do through the Cash App platform. Received payments are visible in your activity feed. 3 Cash App instantly reimburses ATM fees including ATM operator fees for 3 ATM withdrawals per month up to 700 per withdrawal for customers who get 300 or more in paychecks directly deposited into their Cash App each month.

Free to send most payments. However there are some fees youll want to know about if you sign up for an account. SEC fee is 00002210 per 100 of principal and TAC fee is 0000119 per share.

As mentioned earlier the Cash App itself does not charge you any fee for investing in the stocks. However this applies to other payment apps as well and not simply Cash App as a regular cost. Cash App for business is less about getting unique features than about being in compliance with your terms of service.

To review a payment. Available using the Account. Cash App fees.

21 rows All Fees Amount. Cash App charges a 3 fee when paying by credit card and a 15 fee for instant transfers. For example if you need to cash out your balance in a hurry youll have to pay a 15 fee for an instant transfer to your bank account or linked debit card³.

Enter the recipients phone number email address or Cashtag. But wait arent transactions free with a personal account. Scan the QR Code at the Square Sellers point of sale.

If you transfer someone 200 using the Cash App and your connected credit card youll be charged 206. How to send money on Cash App. Enter what the payment is for.

Subject to the Cash App Terms and these Payment Terms we reserve the right to change the fees upon reasonable advance notice. When youre ready to make a payment open Cash App enter the amount you want to send and click Pay.

How To Send Money On Cash App And Use It For Payments

Get 500 On Your Cash App To Spend In 2022 App Cash App Card Ideas Cash

Why Does Cash App Ask For Full Ssn

Does Cash App Have Routing And Account Number

How To Add Money To Your Cash App Or Cash Card

How To Get Free Money On Cash App Gobankingrates

How To Send Money Cash App With Credit Card Cash App How To Send Money Without Debit Card Bank Youtube

How To Add A Bank Account In The Cash App

How To Use Cash App 2022 Youtube

How To Send Money On Cash App And Use It For Payments

Cash App Card Features And How To Get One Gobankingrates

How To Pay With Cash App In Store Or Online Without A Card

Can You Send Money From Paypal To Cash App Android Authority